Most guides on accounting interview questions tell you the same surface things. Brush up on debits and credits. Know GAAP. Prepare examples. Smile.

But when you read hundreds of real conversations, a different pattern appears. Candidates are not tripping on technical weaknesses. They’re tripping on subtleties. The unspoken expectations. The practical tests. The judgment calls. The gaps between textbook answers and real office life.

This article pulls together those hidden lessons so you can walk into your accounting interviews with clarity, not guesswork.

What Interviewers Look for That Job Descriptions Never Mention

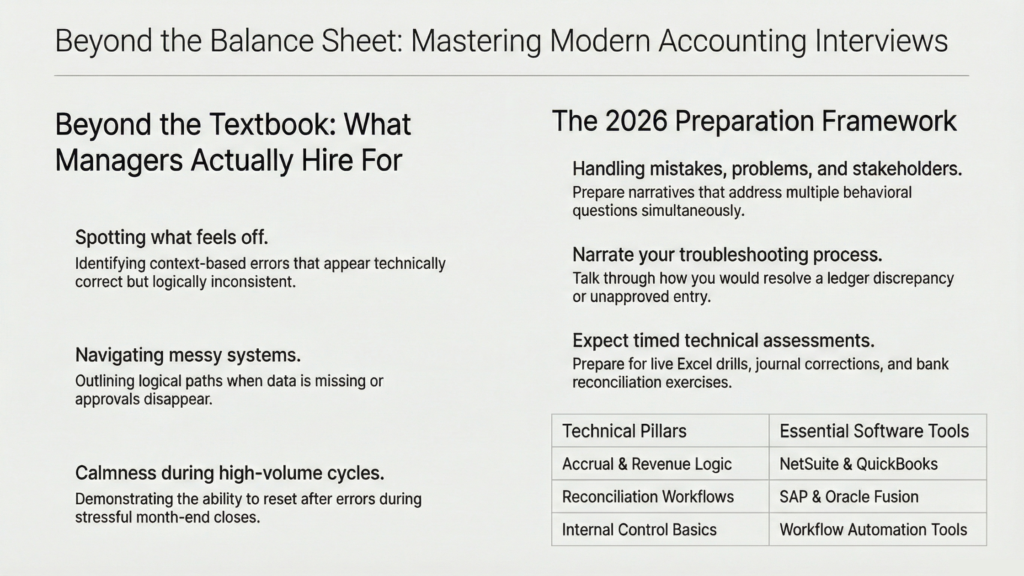

Candidates think accounting interview questions are mostly technical. Managers say otherwise. After hiring dozens of accountants, controllers, AR leads, and billing analysts, interviewers repeatedly highlight four real deciding factors:

1. Pattern recognition under pressure

Accounting is not about memorizing rules. It is about spotting what feels off.

Examples from real interviews include:

- Catching mismatches between vendor invoice dates and payment cycles

- Identifying a small rounding error that hints at a bigger reconciliation problem

- Explaining why an entry looks correct but actually isn’t based on context

Good interviewers purposely design questions so there is no single perfect answer. They want to watch how you think.

2. Your relationship with uncertainty

In many roles the systems are messy. Backlogs happen. Approvals disappear. You may get zero context.

Successful candidates do the following:

- Narrate their approach

- Identify what information is missing

- Outline two or three possible paths

- Choose one based on impact, not guesswork

Your process matters more than your correctness.

3. Emotional steadiness in repetitive work

This comes up constantly in hiring manager threads. Accounting can be repetitive. Month-end can be stressful.

Interviewers quietly evaluate:

- Calmness

- Clarity

- The ability to reset after errors

- How do you communicate when overwhelmed

They do not want dramatic narratives. They want stability.

4. Practical understanding of workflows

Many candidates fail because they understand accounting theory but not real workflows.

For example:

- How does the AP department prioritize payments

- What causes bottlenecks during close

- How reconciliation tools actually work

- What good documentation looks like in a real audit

Managers say this is one of the biggest deal-breakers.

A Simple Framework to Prepare for Modern Accounting Interview Questions

Instead of memorizing lists of accounting interview questions, use this preparation model.

1. Build three core stories

Prepare stories for:

- Handling mistakes

- Solving a messy problem

- Working with difficult stakeholders

These stories answer dozens of questions at once.

2. Practice live thinking

Use mock prompts like:

- A ledger is off. How do you troubleshoot

- You find an unapproved entry

- The month-end is delayed due to another department

Talk through your thinking. This impresses more than perfect answers.

3. Review five fundamental topics

You don’t need deep theory. Just clarity.

- Accruals

- Revenue recognition basics

- Invoice to cash process

- Expense categorization

- Reconciliation workflow

4. Prepare for the inevitable Excel check

Practice a few datasets from Kaggle or mock accounting tasks.

5. Learn your tools

Even light familiarity helps build confidence.

The Questions That Actually Show Up (from real interview transcripts)

After reviewing dozens of real candidate reports, these are the categories you should expect.

Not theories. Not textbooks. Real accounting interview questions in 2025–2026.

Situational problem solving

These appear far more than pure technical questions.

Examples:

- A vendor emails saying they were underpaid. Walk me through your next steps.

- Your reconciliation is off by just sixty dollars. What would you check first

- A journal entry was posted twice last quarter, and no one caught it. What do you do today

These reveal your workflow instincts.

Cross-team collaboration

Hiring managers are tired of accountants who avoid communication.

Expect questions like:

- How do you balance accuracy with urgency when departments push for quick numbers

- How do you explain financial discrepancies to someone non-financial

- Describe a time someone senior pressured you to close something fast

These test your backbone.

Error-handling philosophy

Interviewers don’t care if you never make mistakes. They care how you handle them.

They often ask:

- Tell me about a financial mistake you made and how you fixed it

- What is your personal process for catching small errors

- How do you maintain accuracy during high-volume periods

Your honesty is more important than perfection.

Real technical assessments (often timed)

These come from hundreds of Glassdoor posts:

- Mini bank rec exercises

- Journal entry corrections

- Quick Excel drills

- Interpreting trial balances

- Identifying missing supporting documents

Candidates say these small tasks decide more outcomes than anything else.

Industry Trends You Should Know Before Any Interview

Interviewers love candidates who understand how accounting is changing.

Recent trends that impress managers:

- Automation is reducing manual entry work

- Data quality is becoming a compliance requirement

- Month-end cycles are becoming faster

- Cross-training between AR, AP, and GL is now common

- Documentation standards are getting tighter

Mentioning even one of these makes you look informed.

A Fresh Look at Skills That Matter in 2026 Interviews

Managers now prioritize a mix of technical and behavioral skills. From community threads and employer reports, the skills that interviewers quietly value are:

Technical skill clusters

- Reconciliation accuracy

- Excel fluency (VLOOKUP, PivotTables, INDEX MATCH)

- Understanding of basic internal controls

- Comfort with billing, invoicing, and cash application

- Knowledge of audit documentation

- Financial hygiene habits (versioning, naming conventions, backup trails)

Modern tools you are expected to know or understand

Even if beginner level helps you stand out.

- NetSuite

- QuickBooks

- Zoho Books

- SAP

- Oracle Fusion

- Basic workflow automation

Behavioral strengths that repeatedly impress hiring managers

- Steady communication

- Being transparent when stuck

- Consistent follow-through

- Ability to work without micromanagement

- Emotional neutrality during busy cycles

These show up in hiring discussions far more often than pure textbook knowledge.

Situational questions from 2025-2026 hiring cycles

1. You’re joining a team that’s migrating to a new ERP next quarter. What concerns do you raise on day one?

Mention data mapping, historical migration rules, cutoff dates, testing scenarios, and who owns adjustments.

2. Your manager is unavailable and you find a last-minute discrepancy before reporting. What’s your next step?

They want to hear: escalate to a second reviewer, document findings, prepare two versions (pre-fix and post-fix), and protect reporting integrity.

3. “Tell me the difference between a great accountant and a good one.”

Consensus answers from senior accountants:

• Pattern recognition

• Risk awareness

• Communicating numbers in plain language

• Curiosity about operational drivers

• Strong documentation habits

Insights from Five Job Categories Where Question Styles Differ

Using community interviews, these are the patterns.

1. For accountant interview questions

These interviewers care most about how you think through messy situations:

- Deferred revenue

- Prepaid expenses

- Accruals that shift across periods

- Unexpected discrepancies

They rarely ask trivia. They test reasoning.

2. For account manager interview questions

You will get more questions about communication, account ownership, and escalation handling. They want to see diplomacy, not just math.

3. For accounts payable interview questions

Nearly all interviews test:

- Invoice coding

- Vendor communication

- Discrepancy resolution

- 3-way matching logic

- Understanding of payment timing

Hiring managers say AP fails are usually communication fails.

4. For account executive interview questions

These lean toward business understanding and revenue impact. Expect questions about how your accuracy reduces sales cycle friction.

5. For the classic accountant interview format

Many companies now give a small practical test before any conversation. Candidates report that passing the test matters more than their resume.

What Candidates Regret Not Preparing For

After reviewing dozens of posts from accounting candidates, these are the things people wish they had known earlier:

- They underestimated the soft skills section: Many walked in ready for GAAP questions and froze during a situational scenario.

- They didn’t practice explaining technical thinking out loud: Structured thinking is now a must.

- They ignored small technical fundamentals, especially:

- Adjusting entries

- Accrual logic

- Fixed assets

- Tax basics

- Bank rec prioritization

- They didn’t prepare stories for behavioral questions: STAR method or not, you need three or four concrete examples.

- They assumed Excel questions would be easy: Most regret this. Many interviews include timed Excel tasks.

Final Thoughts

If you prepare only for technical questions, you will miss half the interview.

If you try to memorize every scenario, you will miss the point.

The real goal is to show clarity, steadiness, and practical thinking.

A strong accounting career is built on habits more than brilliance.

If you are exploring new opportunities, CloudHire helps candidates get matched with roles that align with their skills and experience. You can browse current openings or upload your profile to stay informed about future roles.